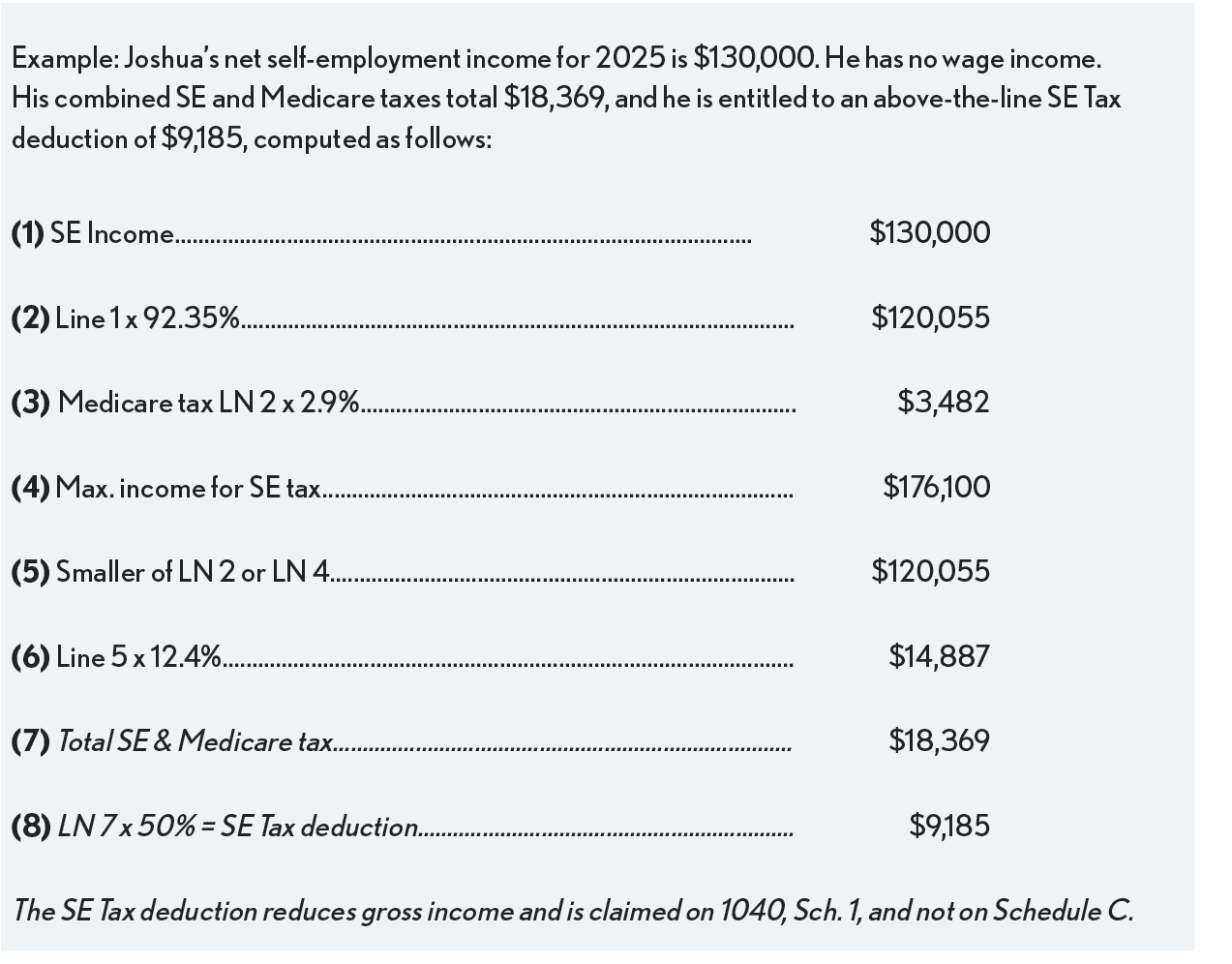

SE Tax Deduction

A taxpayer can deduct one-half of the SE tax computed on Schedule SE for the year as a business expense that is deducted as an adjustment to gross income on Form 1040, Schedule 1, part II (line 15 of the 2021 form). This deduction has no effect on the computation of net SE income or on the computation of SE tax.