Death of Account Beneficiary

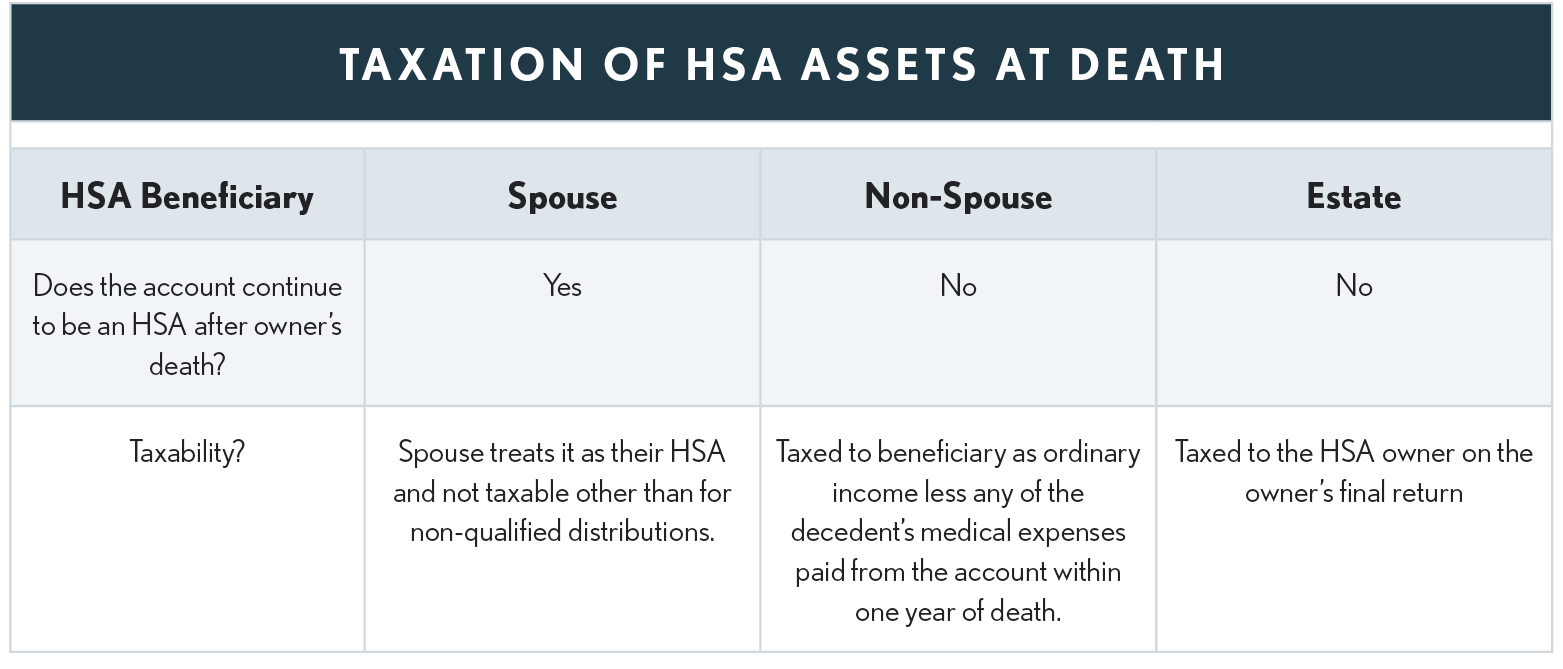

Any balance in the HSA at the account beneficiary’s death becomes the property of the individual named in the HSA instrument as the beneficiary of the account. If that beneficiary is the surviving spouse, the HSA becomes the spouse’s HSA, and the surviving spouse will be subject to income tax only to the extent distributions from the HSA are not used for qualified medical expenses.

Example 1: Jeff and Cheryl are married, and Cheryl is the sole designated beneficiary of Jeff’s HSA with a balance of $50,000. Jeff passes away during the year, leaving the HSA balance to Cheryl. Cheryl can now treat the HSA as her own and use the funds tax-free to pay for her own qualified medical expenses.

-

Non-Spouse Beneficiary

If the beneficiary is other than the surviving spouse, the HSA ceases to be an HSA as of the date of the account beneficiary’s death, and the heir is required to include in gross income the fair market value of the HSA assets as of the date of death. For that person (other than the decedent’s estate), the includible amount is reduced by any payments from the HSA made for the decedent’s qualified medical expenses, if paid within one year after death. Because the HSA is income in respect of a decedent, the non-spouse beneficiary is allowed an estate tax deduction with respect to the part of the estate tax attributable to the value of the HSA that he or she had to include in income.