Tax Computation

Individuals

For individuals, the surtax is 3.8% of the lesser of:

-

The taxpayer’s net investment income or

-

The excess of modified adjusted gross income over the threshold amount ($250,000 for a joint return or surviving spouse, $125,000 for a married individual filing a separate return, and $200,000 for all others). Note: These amounts will not be indexed for inflation.

Example 1: A single taxpayer has net investment income of $100,000 and MAGI of $220,000. The taxpayer would pay NIIT only on $20,000, the amount by which his MAGI exceeds his threshold amount of $200,000, because that is less than his net investment income of $100,000. Thus, the taxpayer's NIIT would be $760 ($20,000 × 3.8%).

-

Example 2: Married taxpayers filing jointly have net investment income of $100,000, the husband has wages of $300,000, and their MAGI is $375,000. The taxpaying couple's NIIT is $3,800 ($100,000 x 3.8%) since their MAGI exceeds the MAGI threshold by more than their net investment income ($375,000 – 250,000 = $125,000). Of special note: In addition to paying the net investment income tax of $3,800, the taxpayers would also pay an additional HI (Medicare) tax of $450 ($50,000 x 0.9%) on his wages in excess of $250,000.

-

Estates and Trusts

For an estate or trust, the surtax is 3.8% of the lesser of (Sec. 1411(a)(2)):

-

Undistributed net investment income or,

-

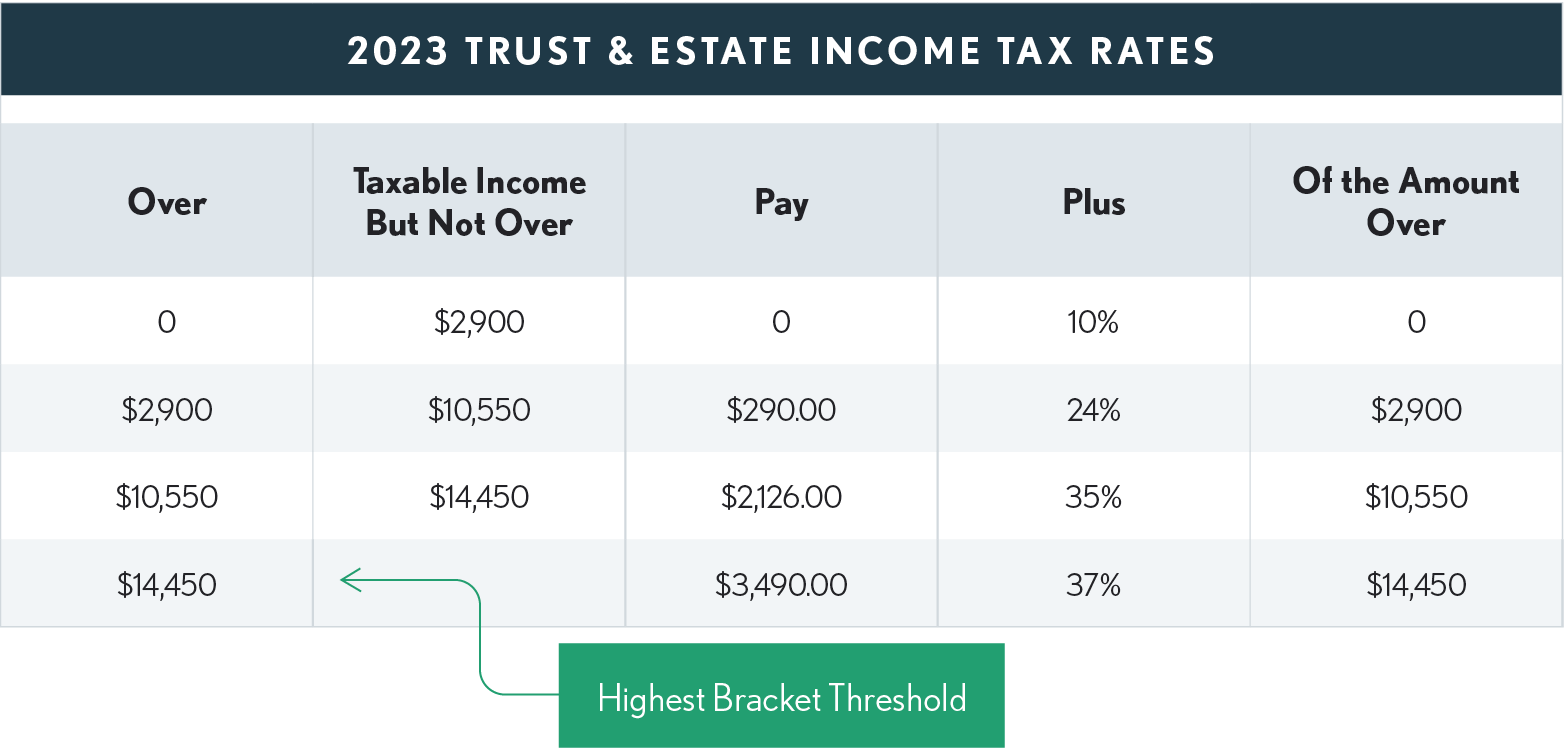

The excess of AGI over the dollar amount at which the highest income tax bracket applicable to an estate or trust begins.

Example 3: In 2023 a trust has undistributed net investment income of $20,000. The highest tax bracket for a trust in 2023 begins at $14,450. The trust’s AGI is $30,000. The excess of the AGI over the initiation point of the highest tax bracket is $15,550. Since $15,550 is less than the $20,000 of undistributed NII, the surtax will be $590.98 (3.8% of $15,550).

-

Simple and Grantor Trusts

Simple trusts require all income to be distributed and don’t provide for charitable contributions. Income from grantor trusts is taxable to the owner (grantor) of the trust. Thus generally, Simple and Grantor trusts are not subject to the surtax.